City of Santa Clara deficit grows larger

While originaly projected as a $6.7 million deficit when the budget was made for fiscal year 2009/2010 (July 1, 2009 through June 30, 2010), a recent revenue report to the City Council on March 30, 2010, revealed that the deficit for 2009/2010 is now expected to be $13.5 million. The city will need to dip deeper into their capital reserve (also known as the emergency reserve). The capital reserve fund will be down to only $2.5 million after this years withdrawal. A deficit is also projected for the coming years. At the April 27th, 2010 city council meeting, city manager Jennifer Sparacino stated that it was expected that the 2010/2011 budget deficit would be larger than the $13.5 million deficit for the 2009/2010 fiscal year. With the capital reserve fund drained, future deficits will have to be dealt with exclusively via the General Fund - by either cutting expenses and services and/or increasing taxes.

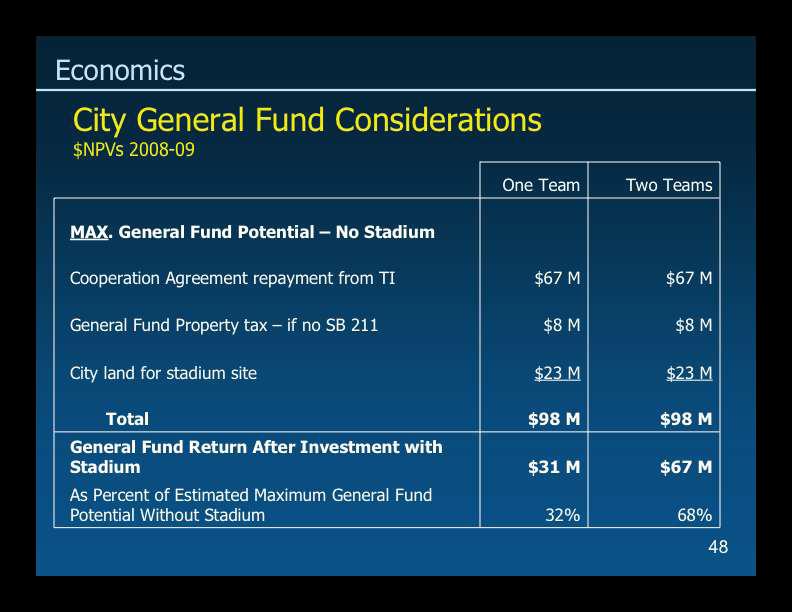

And yet the Stadium Five continues to push for a

city subsidized and owned NFL football stadium, which

city documents show on page 48

that the General Fund

will have $67 million LESS if a stadium is built for the San Francisco 49ers ($31 million less if the

Oakland Raiders also use the stadium):

Reason #1 - Measure J will result in a net $67 million loss to the City's General Fund.

Will Kennedy speaks to Santa Clara Plays Fair

(id SCvoter on youtube.com)

on Reason #1 of

top 10 reasons

to Vote No on Santa Clara Measure J

Most Santa Clarans are not aware of this finding which appears in the city's economic study. What this means is that even after all direct and indirect stadium revenue to the General Fund is counted, the General Fund still ends up losing a net $67 million -- because the revenue is not nearly enough to offset the cost. Unfortunately, the 49ers marketing materials falsely claim that the General Fund will not be impacted. It will, by $67 million.

You may have read that no General Fund money goes into building the stadium. This is literally true, but misleading, because redevelopment money which would otherwise flow into the General Fund will be diverted to pay for stadium construction. This diversion, plus other losses caused by the stadium total $98 million. The expected stadium General Fund revenues over the 40 year lease, including rent and all new taxes, total only $31 million. The result is a $67 million net loss. (i.e. 98-31=$67 million).The General Fund is used by the city to pay for police, fire, libraries and parks, etc. The loss of $67 million will have a major impact on these services. The current General Fund budget is approximately $150 million. $67 million is enough money to keep the city going for over 5 months. While the 49ers promise that there will be no taxes, less money in the General Fund will eventually result in either reduced services or new taxes. The City Council just hasn't addressed that yet.

The $67 million figure is in "net present value" or today's dollars. In nominal dollars, the figure is much greater. We use "net present value" because it is used by city staff, and is consistent with standard accounting principals.

Source: Slide 48 in City's 6/2/09 Powerpoint presentation, "City General Fund Considerations"

Reason #10 - Measure J commits the City to a 2-to-1 loss on our investment.

Will Kennedy speaks to Santa Clara Plays Fair

(id SCvoter on youtube.com)

on Reason #10 of the

top 10 reasons

to Vote No on Santa Clara Measure J

The city is required to direct $114 million towards the stadium project ($106 million net present value). This is made up of Redevelopment money, utility money, and hotel tax money. In addition, we must provide the land for the stadium and lose more money by extending the 49ers sweetheart rent deal at the neighboring training center.

In return, the city receives well less than half of what it puts in - only $57 million in General Fund and redevelopment revenue over the 40 year lease. This is made up of rent ($8 million) projected profits from other events ($18 million) additional sale/property/hotel taxes collected ($29 million) and Senior/Youth Fee ($3 million). These values are in "net present value," or today's dollars. We don't see why the city should enter into a stadium deal which is projected to lose more than two dollars for every dollar taken in.

The 49ers' claim that they pay "fair market value" on the stadium land ignores the fact that in order to receive rent, the city must pay an amount at the beginning of the lease which is worth far more than all of the future rent combined. Also, the majority of what the 49ers call "rent" is not guaranteed, and is not really rent. It is only the possibility of earning money from other events.

You may wonder why the 49ers claim that they will pay $40 million in rent over the course of the lease, and we say it is only $8 million. The difference is that we use "net present value," which accounts for inflation, and the 49ers use nominal value, which does not. The city staff uses net present value. Because most of the rent will be paid many years from now, it will be greatly devalued by inflation. So the value of all of the rent which the 49ers will pay over the 40 year lease is only valued at $8 million by city staff.

The same is true of "performance based rent" (i.e. the city's share of profit from concerts, etc.) which the city values at $18 million, net present value, and the Senior/Youth fee which the city values at $3 million, net present value. The 49ers' campaign materials claim that these amounts are much higher because they use nominal values. Only by comparing the net present value of the costs and the revenues, can you determine whether the project will make, or lose money. That comparison shows that the stadium loses money.

Source:

Slide 35 of City's 6/2/09 Powerpoint Presentation

Source:

Slide 45 of City's 6/2/09 Powerpoint Presentation

Source: Slide 47 of City's 6/2/09 Powerpoint Presentation

Source:

Preliminary Estimate of return after investment from Stadium Project

City of Santa Clara 2009-2010 Annual Budget

How taxes and fees are distributed

Property Tax

When you pay your property tax the City of Santa Clara general fund receives $10.20 of every $100 collected. For the 2009/2010 fiscal year the city anticipates receiving $29.3 million.

| Entity | Dollars |

|---|---|

| Santa Clara Unified School District | $38.40 |

| County of Santa Clara | $18.00 |

| Educational Revenue Augmentation Fund (ERAF) | $15.90 |

| West Valley-Mission College | $11.10 |

| City of Santa Clara General Fund | $10.20 |

| County Office of Education | $4.00 |

| Other Special Districts | $2.40 |

Sales Tax

For every taxable dollar you spend in Santa Clara County, you pay 9.25% or $9.25 for every $100 purchase. Cities throughout the state receive sales tax based on sales made in their respective city. For every $100 purchase you make within the City of Santa Clara which is subject to sales tax, the City receives $1. This year the City anticipates receiving $34.5 million.

| Entity | Dollars |

|---|---|

| State of California | $6.00 |

| Santa Clara Valley Transportation Authority (VTA) | $1.00 |

| City of Santa Clara | $1.00 |

| Santa Clara County | $0.50 |

| Public Safety (Prop 172) | $0.50 |

| County Transporation and Roads | $0.25 |

Sales tax revenue in the City of Santa Clara comes from a wide variety of sources. Sales of new autos, electronic equipment, restaurants and light industry were the City's leading economic categories last year.

| Industry | Percentage |

|---|---|

| Electronic Equipment | 16% |

| New Auto Sales | 15% |

| Restaurants | 9% |

| Office Equipment | 8% |

| Light Industry | 8% |

| Department Stores | 6% |

| Building Materials-Wholesale | 6% |

| Service Stations | 5% |

| Miscellaneous Retail | 4% |

| Leasing | 3% |

| Other Categories | 20% |

Source: City of Santa Clara 2009-2010 Annual Budget: How taxes and fees are distributed

City of Santa Clara 2009-2010 Annual Budget Estimate

Where the City gets its Money

| Taxes | |

|---|---|

| Sales Tax | 34.5 |

| Property Tax | 29.3 |

| Transient Occupancy Tax | 8.5 |

| Other Taxes | 3.5 |

| Intergovernmental | |

| Revenue from Other Agencies | 8.7 |

| Vehicle License Fees | 0.4 |

| User Fees | |

| Charges for Current Services - Utilities | 335.6 |

| Charges for Current Services - Other | 29.5 |

| Other | |

| Beginning Balance/Reserves/Transfers | 66.2 |

| Contribution In-lieu | 14.2 |

| Interest Income | 13.7 |

| Enterprise Capital Projects | 11.7 |

| Rents and Leases | 5.9 |

| Licenses, Permits, Fines, Penalties | 4.8 |

| Other Revenues/Debt Proceeds | 0.9 |

| Total Estimated Revenue | 567.4 |

What your $567.4 million buys:

| Electric | 276.3 |

| Police, Fire, 9-1-1 (Communications) | 80.2 |

| Capital Projects | 53.1 |

| Water & Sewer | 43.9 |

| Debt Service | 21.6 |

| Public Works | 17.6 |

| Solid Waste | 16.9 |

| Parks & Recreation | 13.6 |

| City Administration | 11.4 |

| Finance & Human Resources | 9.8 |

| Internal Services | 8.5 |

| Library | 7.2 |

| Planning & Inspection | 5.9 |

| Convention/Visitors Bureau | 1.4 |

Source: City of Santa Clara 2009-2010 Annual Budget: Where the City gets its Money